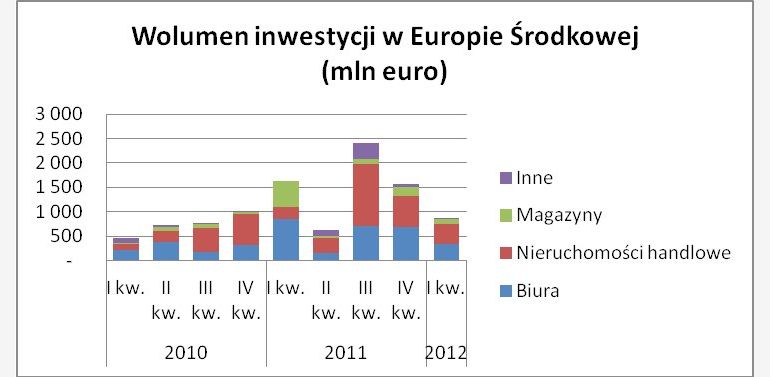

According to Cushman & Wakefield, investment activity in the core Central European markets of Poland, Czech, Slovakia, Hungary and Romania amounted to just € 847 million in Q1 2012. This is substantially below the € 1.3 billion invested during the same period in 2011, but ahead of the € 465 million invested in Q1 2010.

Commenting on the outlook for 2012, Charles Taylor, Partner at Cushman & Wakefield added: In isolation the Q1 figures appear disappointing, but given the level of activity ‘on the ground’, we anticipate a strong bounce back in CE volumes for Q2. Raising finance remains a challenge, but equity buyers, or those with access to debt are taking the opportunity to buy quality assets. With an interesting pipeline of investment product now coming to the market, we anticipate a much more active second half of the year, particularly in Poland and the Czech Republic.

Given the slow start to 2012, Cushman & Wakefield predicts 2012 investment volumes will reach € 4.75 billion, but this remains some way behind last year’s € 6.1 billion reflecting the difficulty and cost of securing finance and a more restrictive supply of investment grade product in certain markets such as Hungary.

For Q1 2012, however, Poland continues to lead the region, with € 728 million invested, marginally ahead of the Q4 2011 volume, but there was negligible activity in Czech, Slovakia or Hungary. Romanian investment volumes increase to € 99 million, the highest level since Q1 2011, but overall activity remained thin with only 12 transactions recorded for the period compared with a quarterly average of 28 transactions in the previous 2 years. Retail investors continued to dominate with a 47% share, followed by office and industrial with 40% and 12% respectively.

Retail market ahead of office market in CE

Not office sector, but retail sector mainly attracts investors to Central Europe. In this region Poland remains a leader with EUR 728 million invested in Q1 2012.